Already enrolled Request enrollment

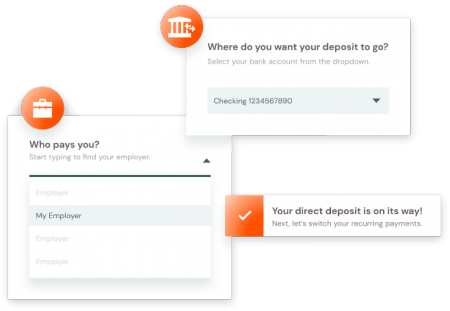

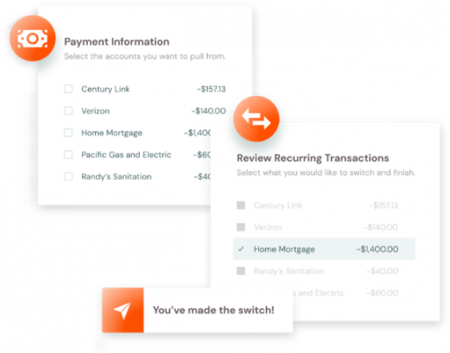

Moving Your Account Is Easy With ClickSWITCH

Our ClickSWITCH process removes the hassle of switching your direct deposit or bill pay services from your current bank to Radiant Credit Union. That’s right moving your direct deposit using ClickSWITCH can take only 90 seconds to complete. And, moving your automatic payments can be just as easy!

Get started today by requesting to enroll in ClickSWITCH by calling Radiant at (352) 381-5200, or toll free at (877) 786-7828, or by completing the brief form below.

Once we have your request, we will contact you directly to confirm the account you wish to enroll and you’ll be on your way!